Almost Show Time (Photo credit: ckaiserca)

Almost Show Time (Photo credit: ckaiserca) Ottawa Canada July 2010 — Ottawa Tourist Bureau 13 (Photo credit: dugspr — Home for Good)

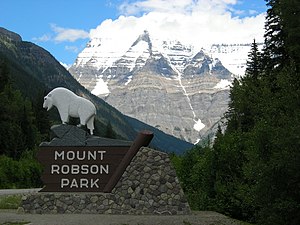

Ottawa Canada July 2010 — Ottawa Tourist Bureau 13 (Photo credit: dugspr — Home for Good) Entrance of Mount Robson Provincial Park, British Columbia, Canada (Photo credit: Wikipedia)

Entrance of Mount Robson Provincial Park, British Columbia, Canada (Photo credit: Wikipedia) English: Coat of arms of British Columbia (Photo credit: Wikipedia)

English: Coat of arms of British Columbia (Photo credit: Wikipedia) Great to see Sustainable Prosperity in Montreal! (Photo credit: m.gifford)

Great to see Sustainable Prosperity in Montreal! (Photo credit: m.gifford) English: Denis Rancourt, Professor of Physics, University of Ottawa, Ottawa, Ontario (Photo credit: Wikipedia)

English: Denis Rancourt, Professor of Physics, University of Ottawa, Ottawa, Ontario (Photo credit: Wikipedia)The View From Here

Hilary's musings & miscellaneous missives

Sustainable what?!

A few days ago, I heard an item on CBC news which reminded listeners that British Columbia’s infamous “carbon tax” (thank you so much, Andrew Weaver) will be increased again on Canada Day (July 1). This supposedly “revenue neutral” tax was introduced some years ago

This news item also indicated that this increase will be the last – and that BC’s premier had announced that there will be a review of this tax which will be completed (if my memory serves me correctly) by August 31. When I went off in search of further details of this review, the first article I came across was from the Globe and Mail

B.C. to raise carbon tax, price of gasoline July 1British Columbia is set to boost its controversial carbon tax by $5 a tonne on July 1, further driving up the price of gasoline and other petroleum products as the province attempts to cut greenhouse gas emissions by 33 per cent below 2007 levels by 2020.

Environment groups have applauded the province’s carbon levy, which was offset by cuts to personal and corporate income taxes when it was introduced four years ago. The carbon tax has contributed to a 15 per cent drop in British Columbians’ use of petroleum-based fuels since it was introduced in 2008, said an Ottawa-based think tank, Sustainable Prosperity,

Sustainable Prosperity says it has led to substantial reductions in greenhouse gas emissions that are linked to climate change, but has had no negative impact on economic growth, as some critics feared.

Lead author and researcher, Professor Stewart Elgie, University of Ottawa, Faculty of Law and Institute of the Environment.

Stewart Elgie is a professor of law and economics at the University of Ottawa, and director of the University’s interdisciplinary Environment Institute. He received his Masters of Law from Harvard, and his doctorate (J.S.D.) from Yale (thesis on forest carbon markets).

What is Environmental Pricing Reform (EPR)?And:

Environmental pricing reform (EPR), or “getting the prices right” is the process of adjusting market prices to include environmental costs and benefits. Where market prices omit environmental costs and benefits, rational economic decisions lead to environmental harm, as well as to economic distortions and inefficiencies. Getting the prices right can help to protect the environment and boost Canada’s prosperity.

What kinds of changes does Sustainable Prosperity want?In light of all of the above, some might be inclined to conclude from the green-tinted findings in Sustainable Prosperity’s “Research Report” on BC’s carbon tax that “well, they would say that, wouldn’t they?”.

We are seeking changes in policy – federally, provincially, and locally – to implement EPR across Canada. EPR means a change in the rules of the game, and a levelling of the playing field, so that cleaner goods and services become cheaper. EPR policies, also known as “market based instruments” (MBI) or “economic instruments,” include tax shifting, cap-and-trade emissions reductions, and developing markets for ecological services.

One might be forgiven for wondering if this “Research Report” – far from being the product of “credible research” – is yet another well-co-ordinated propaganda exercise from academic-advocates dedicated to a “cause”.

At this point I was about ready to shout. Instead I far too briefly commented.

The University of what ? Um. Denis Rancourt embarrassed the place twice : once by not subscribing to Israel First policies ( thank MJ Rosenberg for that quip ) and secondly for leading a class investigative project which finished up under a quite assertive takedown of AGW fraud.

http://activistteacher.blogspot.ca/ Oh yes. He’s fighting dismissal from a tenured position.

About now we need to recall that business about the UN - and the existence of UNESCO alone should tell us all we need to know about their desire to shape information to their own ends - using the IPCC as a front to design and run a tax generating scare. From the Notes in the left column in fact

Since its origins, the IPCC has been open and explicit about seeking to generate a ‘scientific consensus’ around climate change and especially about the role of humans in climate change

Now, there are reasons to be skeptical of forecasting the future at the best of times. This thing just keeps getting deeper and deeper. Environmental Challenges

Here's another new report that adds grist to the mill.

http://activistteacher.blogspot.ca/ Oh yes. He’s fighting dismissal from a tenured position.

And while I think of it

http://e360.yale.edu/

BTW I usually go by Opit ( oldephartteintraining )

Opit’s LinkFest! has quite a collection under Climate in Contention ( Find in the Topical Index )

..................................................................................................................................................

Search under Lendman Rancourt Palestine

http://e360.yale.edu/

BTW I usually go by Opit ( oldephartteintraining )

Opit’s LinkFest! has quite a collection under Climate in Contention ( Find in the Topical Index )

..................................................................................................................................................

Search under Lendman Rancourt Palestine

Now search Rancourt global warming fraud

About now we need to recall that business about the UN - and the existence of UNESCO alone should tell us all we need to know about their desire to shape information to their own ends - using the IPCC as a front to design and run a tax generating scare. From the Notes in the left column in fact

Since its origins, the IPCC has been open and explicit about seeking to generate a ‘scientific consensus’ around climate change and especially about the role of humans in climate change

Now, there are reasons to be skeptical of forecasting the future at the best of times. This thing just keeps getting deeper and deeper. Environmental Challenges

Here's another new report that adds grist to the mill.