Image by usedego@ymail.com via Flickr

Image by usedego@ymail.com via FlickrPakistan Flood Victims Tell of Suffering, Unfolding Disaster in Southern Sindh Province

Pakistan is still reeling from the worst floods in its history. The top United Nations emergency relief official Baroness Amos visited the southern Pakistani province of Sindh this week and described the disaster as an immense and still unfolding catastrophe. She said there is a new emergency being created everyday, adding that people were most concerned about diseases, hunger, and the lack of adequate shelter.

Some 21 million people have been affected even as the flooding continues. Forty villages were submerged in the past few days and a 50 foot breach in an embankment this morning has sent flood waters surging towards three more towns.

Floods live on in nightmares of Pakistan children

A small seven-year-old girl in a purple dress is being quietly coaxed into speaking.

She looks up suspiciously at us, the new visitors to the Nowshera Girls' Technical College in Pakistan's Khyber-Pakhtunkhwa province. But she is not a pupil. Tajjula lives here with her family, along with hundreds of other families who have taken refuge from the floods, crammed into classrooms off a long concrete hall.

Continue reading the main story

"[The children] don't fit in anywhere in these busy camps" Zerena Social worker

She speaks in barely a whisper; I have to bend right down to hear say her name and where she used to live.

"She's much better than she was". "She didn't speak when she came - we find that with a lot of children. Their parents tell us they are much more fearful of everything now, after the floods, and some don't talk at all."

Brazil rescues farm workers from slave-like conditions

Brazil's government launched a plan to eradicate slavery in 2002.In May, Joao Pedro Stedile, a top official at the Movement of Landless Workers (MST), said 5,266 workers living in near-slave conditions had been rescued in 2008.

But he warned that there were likely to be four to five times more.

Rogue protein 'may spark diabetes'

Insulin is made in "beta cells" in the pancreas, and scientists first noticed "deposits" of the amyloid protein in pancreatic tissue of some people with type 2 diabetes some years ago. A type of immune cell called a macrophage, whose normal role is to get rid of debris in the cell, reacted abnormally when it ingested amyloid.

It triggered activity in other cells nicknamed "angry macrophages", which in turn released proteins that cause inflammation.The inflammation then destroys the vital beta cells, and the ability to produce insulin is reduced.

Colon cancer cases 'may rise 50%'

If UK trends in obesity and activity stayed as they are now, the predicted figure of approximately 35,000 cases a year is reached by 2040.If obesity gets worse, following trends set in the US, where the problem has spiralled in recent years, then the annual figure is close to 37,000.

Five U.S. medical workers arrested in Zimbabwe

Five American medical professionals, including two doctors, two nurses and one organizer were arrested Thursday on their way to distribute donated AIDS drugs in Zimbabwe, media reports say.

The Americans were held in Harare on Saturday, waiting to face a charge of dispensing the medicines without the supervision of a pharmacist or sans proper licenses, according to their lawyer Jonathan Samukange.

These Americans, who are affiliated with the Allen Temple Baptist Church AIDS Ministry in Oakland, California were scheduled to appear in court on Saturday for a bail hearing, their lawyer said. On Monday they will also appear before a magistrate.

Since 2000, the church has sent its members to Zimbabwe three or four times a year to disperse antiretroviral drugs, dietary supplements, clothing and nutritious foods to people with AIDS throughout impoverished regions within the country.

The American medical workers, whose names were not released, reportedly carried enough antiretroviral drugs to treat about 800 people with AIDS in Harare and Mutoko for four months. Most of the beneficiaries would have been orphaned children.

Analyzing The Facebook Contract: Is Mark Zuckerberg Screwed?

How American Stimulus Creates Jobs In China Rather Than America

Andy Xie has an interesting angle on why U.S. stimulus won't work this time around, and we've decided to run with it. Essentially, the world is too globalized today, whereby demand remains local but 'supply is global'

Yet in today's globalized world, companies don't need to expand within the U.S. in order to meet stimulated U.S. demand. They can expand their facilities in other countries, say China, in order to meet stimulated American demand. Thus American stimulus doesn't create a sustainable cycle of economic expansion within the U.S. as it used to -- it creates jobs in places like China rather!

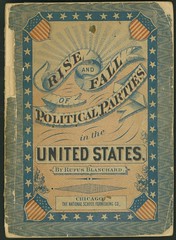

Image by Cornell University Library via Flickr

Image by Cornell University Library via Flickr

Niall Ferguson: Paul Krugman Is Wrong, U.S. Borrowing Will Be Devastating

Ferguson argues that rates are rising because the US is planning to borrow at least $10 trillion over the next 10 years (which we can't afford to do). Krugman says rates won't rise no matter how much we spend because there's a "global savings glut."For now, it seems, Ferguson is right. And it's hard to see how those who have scrimped and saved their way to a global glut will want to vaporize the savings by investing them in collapsing dollars.

Even Krugman seems to concede this. Ferguson again:

But the stimulus package only accounts for a part of the massive deficit the US federal government is projected to run this year. Borrowing is forecast to be $1,840bn – equivalent to around half of all federal outlays and 13 per cent of GDP. A deficit this size has not been seen in the US since the second world war. A further $10,000bn will need to be borrowed in the decade ahead, according to the Congressional Budget Office. Even if the White House’s over-optimistic growth forecasts are correct, that will still take the gross federal debt above 100 per cent of GDP by 2017. And this ignores the vast off-balance-sheet liabilities of the Medicare and Social Security systems.

If Foreclosures Don't Double Soon, Clearing The Real Estate Mess Will Take 8 Years

If monthly Foreclosures double (hypothetically) to 180k from April’s record 92.5k and stay at that level — based upon the 1) monthly average Notice-of-Default (NOD) 2) HAMP and private mortgage mod volume 3) and conservative cures and redefault rates — it will take 42 months to clear the portion of the 8mm loans presently in the distressed pipeline that will ultimately be liquidated. If Foreclosures remain at April’s record high of 92.5k, it will take 101 months.

Greece PM rules out restructuring of national debt

Greek Prime Minister George Papandreou has said restructuring the nation's debt would be "catastrophic" for the country's credibility and its economy.

If debt repayments were suspended, he said Greece "would head towards a potential and probable collapse of the banking system".Eco-car show wows enthusiasts in London

British troops investigated for heroin smuggling

According to a 2008 UN report, 98% of the country's opium is grown in just seven provinces where there are permanent Taleban settlements and where organised crime profits from the instability.

Sex movie worm spreads worldwide

Windows worm contains a link to PDF that a recipient has been told to expect.

Those clicking on the link get neither movies nor documents but give the malware access to their entire Outlook address book.When installed, the worm sends copies of itself to every e-mail address it can find.

The malicious e-mail messages have a subject line saying "Here you have" and contain a weblink that looks like it connects to a PDF document. Instead it actually links to a website hosting the malware.

Once it is installed, the worm tries to delete security software so it remains undetected.

As well as spreading via e-mail, the worm also tries to find victims by looking for open net links from infected PCs and exploiting the Windows Autorun feature on USB drives and other attached media.

Although not widespread, reports suggest that some corporations were hit hard by it. Nasa, AIG, Disney, Procter & Gamble and Wells Fargo were all reported as struggling to contain an outbreak of the worm.

No comments:

Post a Comment